From CNN Special Investigations Unit's Drew Griffin and David Fitzpatrick

PHILADELPHIA, Pennsylvania (CNN) – If you're out of work like Steve Lippe, who was laid off from his job as a salesman in January, you know you already have problems. But looking at the fine print that came with his new unemployment debit card, he became livid.

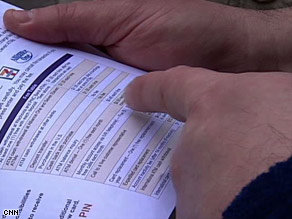

"A $1.50 [fee] here, a $1.50 there," he said. "Forty cents for a balance inquiry. Fifty cents to have your card denied. Thirty-five cents to have your account accessed by telephone."

He was quoting fees listed in a brochure that goes out to every unemployed person in Pennsylvania who chooses to receive benefits via debit card. He was given the option when he filed for jobless payments: Wait 10 days for a check or get the card immediately. Like most of the 925,000 state residents who received unemployment benefits in February in Pennsylvania, he chose the debit card and only then, he says, did he learn about the fees.

"I was outraged by it," he told CNN. "I was very noisy about it. I just couldn't believe it. An outrage is just too weak a word. It's obscene."

According to the U.S. Department of Labor, 30 states offer direct deposit cards to the unemployed. Many of the nation's biggest banks have contracts with the individual states. JP Morgan Chase, for instance, has contracts with seven states and has pending deals with two others, according to Chase spokesman John T. Murray. About 10 states, the Labor Department says, pay by check only.